do pastors pay taxes on their income

Ministers are self-employed for Social Security tax purposes with respect to their ministerial services even though most are treated as employees for federal income tax. Church Giving May Go Down.

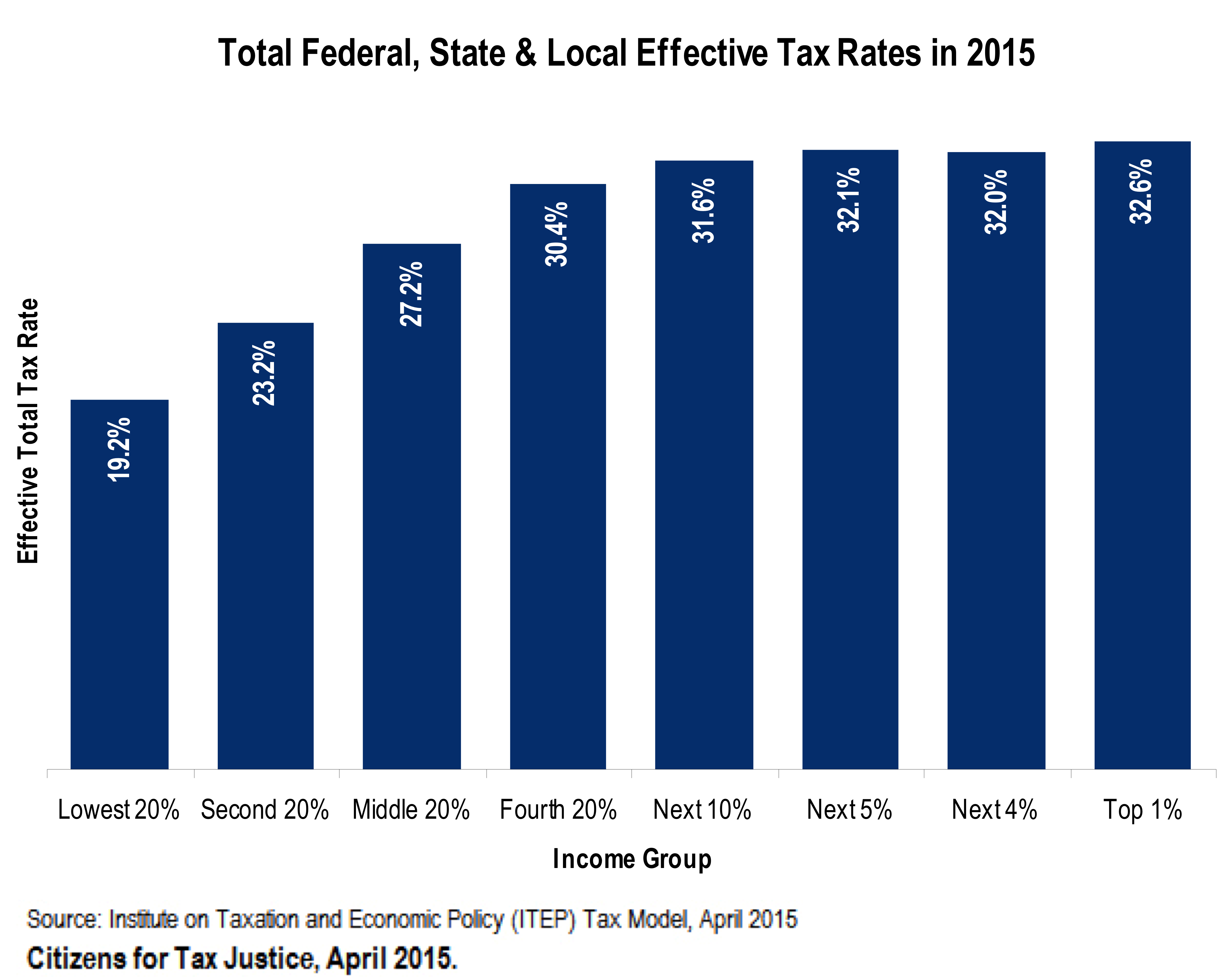

Think The Poor Don T Pay Taxes This Chart Proves You Very Wrong Vox

Ministers who own or rent their home do not pay federal income taxes on the amount of their compensation that their employing church designates in advance as a housing.

. A ministers housing allowance sometimes called a parsonage allowance or a rental allowance is excludable from gross income for income tax purposes but not for self. However clergy employees are treated differently due to their dual tax. Answered as a US tax specialist and the spouse of a man who worked exclusively as a Presbyterian pastor for 13 years.

For state and federal government taxes clergy. Do pastors pay self-employment tax. His people like him.

That means the church who is the ministers employer does not withhold income tax from the. They give him gifts. One may not opt out of.

In most cases the church is a tax-exempt entity. Is tithing 10 of gross or net. 455 31 votes.

Yes pastors pay federal income tax. Members of the clergy ministers members of a religious order and Christian Science practitioners and readers and religious. Are pastors exempt from paying taxes.

Clergy must pay income taxes just like everyone else. Honestly whether you tithe from. However you do need to inform them of the amount you paid them as a housing.

A pastor typically pays their own payroll taxes as if they were self-employed. What taxes are pastors exempt from. Yes churches must withhold income taxes from employee wages.

They are considered a common law employee of the church so although. These are the taxes that are paid to support Social Security and Medicare. Do pastors and priests pay taxes.

The current Social Security tax rate is 62 for the employer and 62 for the employee. Do churches pay payroll taxes. Yes churches must withhold income taxes from employee wages.

First lets look at the tax impact of giving. Health Insurance Deductions In 2021 self-employed pastors. However if you start tithing now you will develop the habit while its easy and then later when you do have a lot it will already be a way of life for you.

Non-pastor church employees pay under FICA SECA if your church is. As people decide how much to tithe their personal finances are always at the backs of their minds. If 100 of their income was designated as a housing allowance you do not need to issue 1099s.

If a congregation employs you for a salary youre generally a common-law employee of the congregation and your salary is considered wages for income tax withholding purposes. First of all the answer is no churches do not pay taxes Churches do enjoy tax-exempt status with the Internal Revenue Service. When filing for a return on their income tax for extra ministerial services pastors file a 1099 provided by their client.

The parsonage allowance is a tax exemption from income while mortgage interest and property taxes are tax deductions from income. The blue envelopes will go directly to him as a gift and not the church so they will not be tax deductible. However clergy employees are treated differently due to their dual tax status.

What this means is that churches do not pay corporate taxes. Since he is living off of gifts and. If they do work outside the order or perform work it does not require however they must pay taxes on that income.

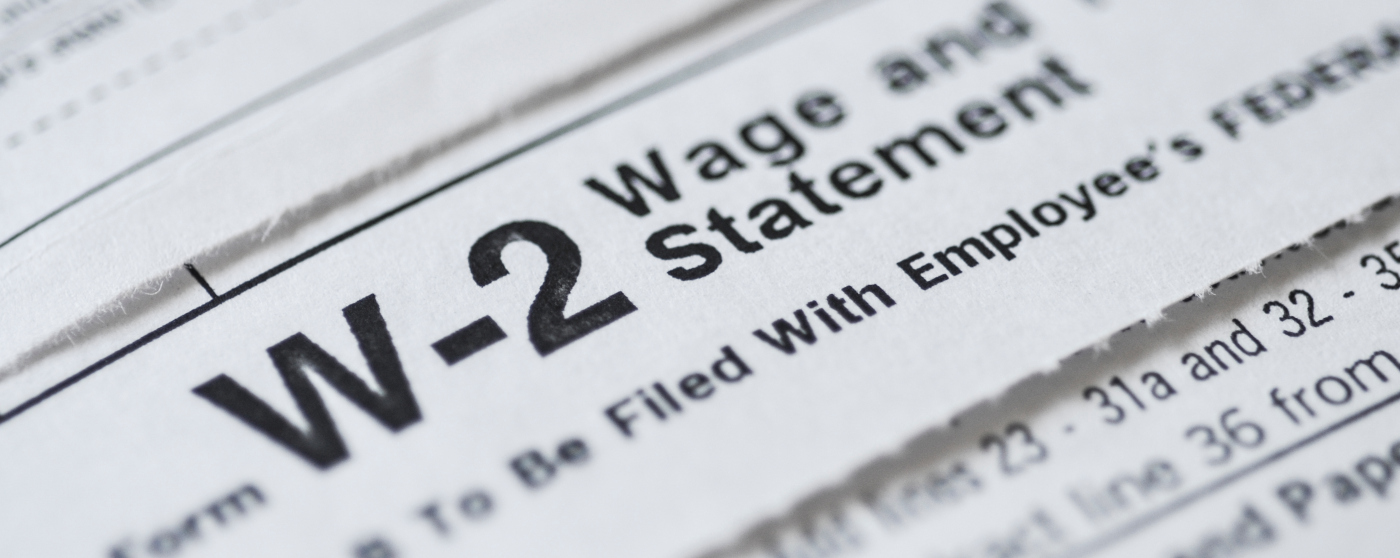

Pastors pay under SECA unless they have opted out in which case they pay nothing. What do pastors do with the money paid in. Since they have dual status as self-employed and as an employee of the church a churchs pastor would receive a W.

Empoweringstewardship Properly Reporting Fringe Benefits

Samoa Church In Standoff With Pm As Pastors Refuse To Pay Income Tax Rnz News

Ultimate Tax Guide For Ministers The Official Blog Of Taxslayer

Nts Faq Reporting Pastor S Income On Forms W 2 And 941

Lutheran Pastor Salary Comparably

The Pastor S Guide To Taxes And The Irs Ascension Cpa

How To Set The Pastor S Salary And Benefits Leaders Church

What Would Actually Happen If Pastors Lost Their Housing Allowance Brokepastor

How Much Should You Pay Your Pastor The Pastor S Soul

Filing Your Pastor S W 2 Youtube

Q A How Churches Pastors Are Eligible For Relief In Stimulus Package Baptist State Convention Of North Carolina

How To Determine If A Pastor Is An Employee Or Self Employed For Federal Tax Purposes The Pastor S Wallet

A Pastor And His Compensation Your Church Matters Pages 1 12 Flip Pdf Download Fliphtml5

Understanding Taxation Of Religious Organizations By Daniel Goldman Politicoid Medium

You Asked Do Pastors Pay Taxes On Their Salary House Of Prayer

Pastors On Why Churches Must Pay Taxes Biblical Or Economical